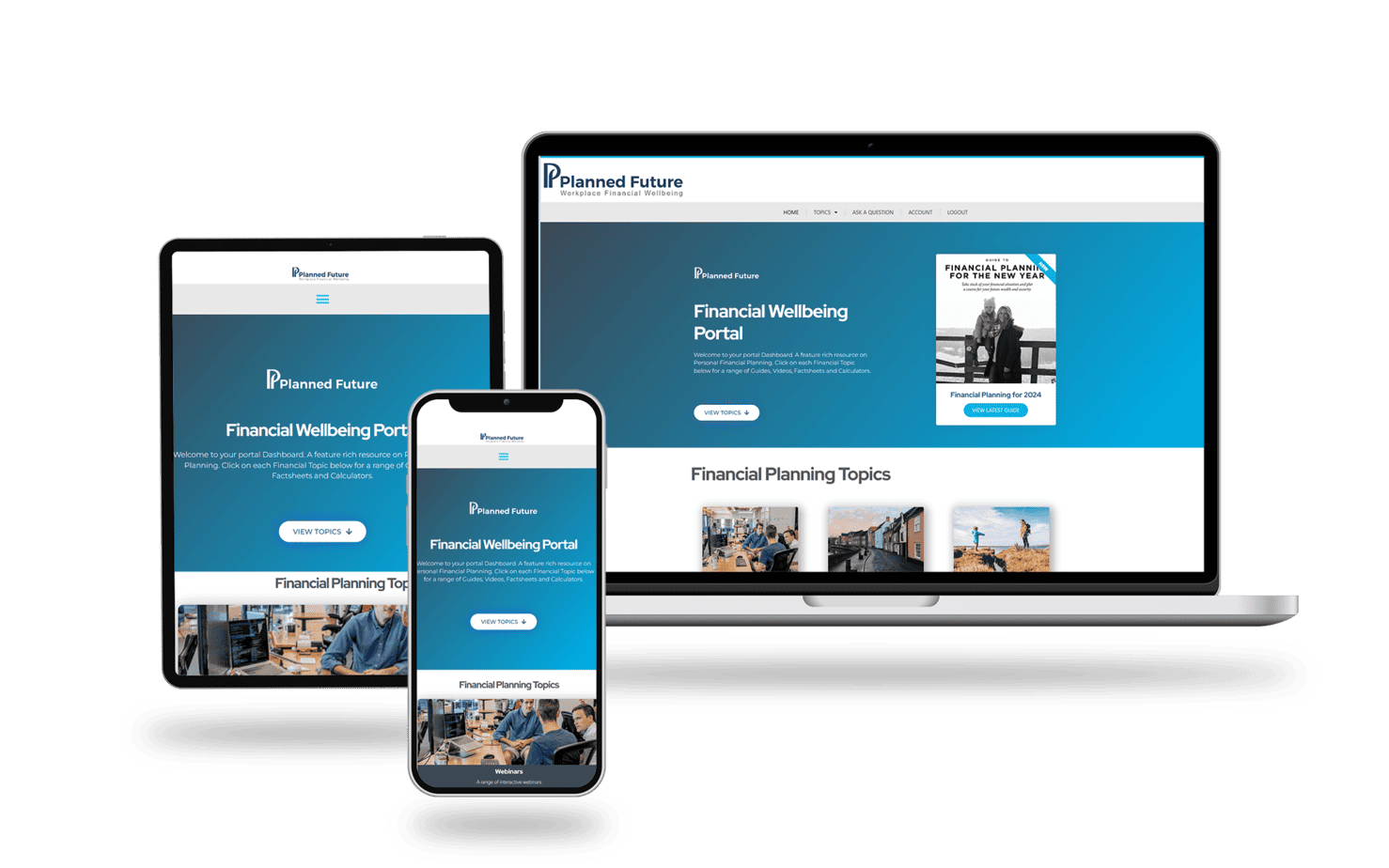

Financial Wellbeing Portal/App

Our online financial wellbeing portal has been designed to help improve your employees financial wellness online.

The portal includes a wide range of financial information including guides, videos , calculators and more.